how much did you pay in taxes doordash

If you didnt earn 600 during a tax year by driving for DoorDash you would not receive a 1099-NEC form. You can deduct expenses from that income such as mileage uniforms.

Doordash Taxes 13 Faqs 1099 S And Income For Dashers

Take note that companies are only required to issue a 1099 if the.

. How much do Dashers pay in taxes. For 2020 if you make more than 600 in self-employment income you have to file a tax return. Answer 1 of 2.

That means you can realistically expect to make anywhere from 1200 to 2000 a month delivering part-time for DoorDash. DoorDash the owner of the tech that forms the connection between you and your product 4. Each mile you drove while using DoorDash in 2021 subtracts 56 cents from your income or about 8 cents off your.

DoorDash allows you to use Visa gift cards as if they were a generic Visa. Generally you can expect the IRS to impose a late payment penalty of 05 percent per month or partial month that late taxes remain unpaid. Yes - Just like everyone else youll need to pay taxes.

This question has also become a recurring one. You can figure this out by subtracting 11000-9701. If you earned 600 or more you should have received an email invitation in early January the subject of the email is Confirm your tax information with DoorDash from Stripe to.

Customers can also order from hundreds of restaurants in their area on the DoorDash platform. It doesnt apply only to DoorDash. The only difference is nonemployees have to pay the full 153 while employees only pay half.

Basic Deductions- mileage new phone phone. So on the first 9700 dollars you will pay 10 or 970 dollars in taxes. Because this is a necessity for your job you can deduct the cost of buying the bag at tax time.

This includes 153 in self-employment taxes for Social Security and. This includes Social Security and Medicare taxes which as of 2020 totals 153. The subscription is 999month and you can cancel anytime with no strings attached.

All independent contractors pay a 153 tax for Medicare and Social Security on top of their income taxes since taxes arent withheld from their. That doesnt mean you dont have to pay your taxes though. Personally when im estimating how much to save for doordash taxes and.

Its the contractors responsibility to report. Didnt get a 1099. If you know what your doing then this job is almost tax free.

You subtract your DoorDash expenses so you only pay tax on your net profit. If youre a Dasher youll be getting this 1099 form from DoorDash every year just in time to do your taxes. When i filed my taxes i had to pay state and local taxes because doordash doesnt take anything out.

How much does Instacart pay per day. So you will pay with this card. Im only paying 900 in taxes on my DoorDash earnings after making 26k last year.

You can make 2400-4000month delivering full. And the answer is Yes. DoorDash requires all of their drivers to carry an insulated food bag.

From there youll input your total business profit on the Schedule SE which will determine how much in taxes youll pay on your independent income. If you earned more than 600 while working for DoorDash you are required to pay taxes. Expect to pay at least a 25 tax rate on your DoorDash income.

Then on the 9701-11000 dollars you would need to pay 12 of that. If the 1099 income you forget to.

Doordash Driver Pay After Taxes Is It Worth It 2021 2022 Youtube

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Comparing Self Employment Taxes To Income Taxes Self Employment Tax Is A New Things When You Become An Independent Contracto Federal Income Tax Tax Income Tax

See How Much Doordash Drivers Make Pay Ranging From 1900 Week To 3 Orders Ridesharing Driver

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

There S Free And Then There S Me As Your Tax Preparer I Promise To Offer A True Concierge Tax Experience I Make I Tax Money Tax Preparation Turbotax

I Began Doing Doordash Last Year And Am Filing My Taxes In A Few Weeks I Saw On The Doordash Website Section About Taxes That Milage Info Would Be Sent Out On

How Can I View My Delivery History With Doordash

The Complete Guide To Doordash 1099 Taxes In Plain English 2022

How Much Money Can You Make With Doordash Small Business Trends Business Tax Deductions Improve Your Credit Score

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Updated Doordash Top Dasher Requirement Note That Popped Up In The Dasher App Promising Top Dasher Will Now Give You Priority In 2022 Doordash Dasher Opportunity Cost

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Is Your Insurance Covering You While You Deliver For Doordash Most Personal Policies Exclude Delivery Work Meaning They Won Doordash Car Insurance Insurance

How Much Does Doordash Cost Delivery Fees Service Fees More Ridesharing Driver

You Can Make Decent Money On Doordash In 2022 You Just Need To Know How Use These Tricks From Top Earning Dashers To Level Up In 2022 Tax Help Filing Taxes Doordash

See How Much Doordash Drivers Make Pay Ranging From 1900 Week To 3 Orders Ridesharing Driver

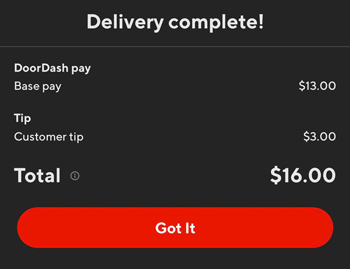

No Free Lunch But Almost What Doordash Actually Pays After Expense Payup Doordash Payroll Taxes Algorithm